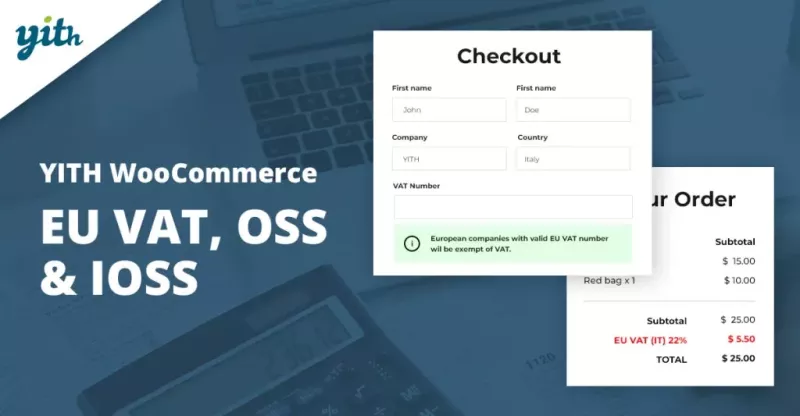

Manage the EU VAT exemption for your B2B customers and add compliance with the new One Stop Shop procedure of the European Union.

A shop owner that sells products or services in the EU needs to know, and fulfil, the requirements of EU VAT laws: our plugin YITH WooCommerce EU VAT, OSS & IOSS helps you to geolocate and identify your European customer’s location and automatically apply the correct VAT rate for B2C orders.

If you sell B2B, this plugin allows you to show a field in the check-out page where businesses can validate VAT and be exempted from VAT at your store.

The plugin is also updated to help you handle the new One-Stop-Shop (OSS) procedure required for all online retailers managing EU sales from 1 July 2021. With this plugin, you can monitor the sales threshold (10.000 €) for B2C exports to other EU countries, generate tax reports (monthly, every 3 or 6 months, yearly, etc.) and export them as CSV to easily notify your local tax authorities about your sales.

Only our members are allowed to comment this post.